Consulting firms have a unique way of interviewing candidates. They use a case interview, where they present a real business problem that you need to break down and solve.

These interviews give consulting firms a direct indication of whether you would be a good consultant, as they test both hard skills (like problem-solving) and soft skills (like communication).

As a candidate, it is crucial that you have a clear and structured approach to tackling these case interviews. In other words, you should be familiar with frameworks and methodologies to solve different business problems.

One common case interview is a profitability case. So in this article, I will teach you how to use the Profitability Framework to confidently solve profitability cases.

Understanding the Profitability Framework

What is a case interview framework?

Let’s start with the concept of a framework…

A framework is a template that can be applied to break down and solve case interview questions. As a candidate, it gives you a clear starting point and a generic process to follow.

But frameworks are just a starting point. You will need to customize your approach based on the specifics of the case question you are given.

What is the Profitability Framework?

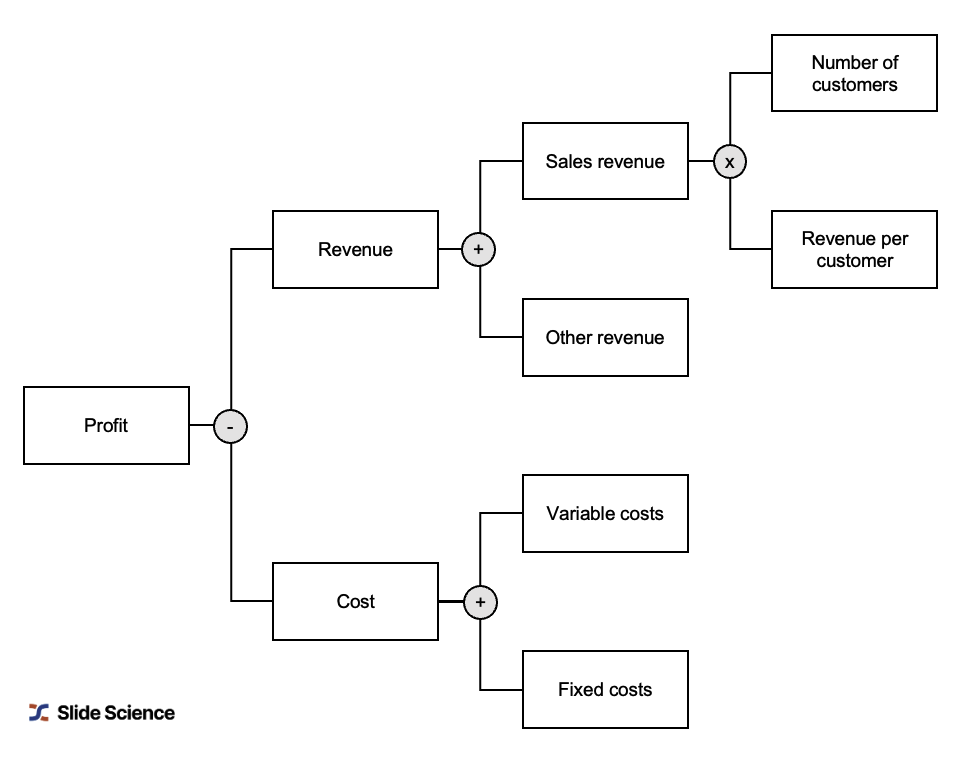

The Profitability Framework is a simple equation used to solve any profitability case interview question. The equation is: Profits = Revenue - Costs.

I’m sure this resonates with you all very well, as this is just how we calculate any profit in real life too, and consulting cases are no different!

However, during a case interview, you are expected to further break down the equation until you’ve identified to root causes of the company’s profitability issue.

Types of profitability case interview questions

It’s important that you’re able to quickly determine that your case interview question is a profitability question — and that’s not always obvious!

There are three main forms that profitability case interview questions may take:

- Profit problem: For example, a client company has hired you as a consultant to increase profitability or profitability growth. This is the most straightforward and easy-to-identify profitability case interview question.

- Loss problem: For example, a client company has been losing money for the last 3 years and wants you to identify and fix the issue.

- Margin problem: For example, a client company has seen tightening margins over the last 2 years and wants you to address the issue.

How to apply the Profitability Framework

Once you’ve identified that your case interview question is a profitability question, you need to apply the Profitability Framework.

Fortunately, there’s a simple process that you can follow:

Step 1: Identify the specific profitability issue

First, you need to identify the profitability issue that the company is facing.

You will get some information from the interviewer when they read out the case scenario. But it’s also likely that you’ll need to ask questions to uncover more information.

Some examples of things to look for include:

- Profit is lower than competitors

- Profit is lower than historical levels

- Profit growth has changed

- Margins are shrinking

Step 2: Break down the revenue side of the equation

Next, you’ll need to figure out whether the profitability issue is due to falling revenues. To do this, you’ll need to break down revenue into its drivers.

There are multiple ways to break down a company’s revenue. You’ll need to figure out the most appropriate way, based on the case interview question that you’ve been given.

Some common revenue breakdowns include:

- Number of sales x revenue per sale: This breakdown is useful for businesses that sell multiple products or SKUs, and where revenue per sale is highly variable.

- Number of customers x revenue per customer: This breakdown is useful for businesses that offer a limited range of solutions, such as subscription-based products or services businesses.

- Break down revenue by business unit or geography: You can also breakdown revenue by function or location to identify performance differences in different parts of the business

Step 3: Break down the cost side of the equation

Now you must break down the cost side of the equation. Again, you’ll need to determine the most appropriate way to break down costs.

Some common breakdowns include:

- Fixed vs variable costs: Understand whether there are issues with variable costs that scale with output (e.g. raw materials, packaging, production labor, etc) or with fixed costs (e.g. rent, utilities, etc)

- Operating vs non-operating costs: Understand whether there are issues with the operating costs associated with running the business (e.g. salaries, supplies, materials, etc) or non-operating costs (e.g. debt interest, taxes, etc).

- Break down cost by business unit or geography: Just like you did for the revenue side, you can also segment costs by function or location to identify whether the underlying issue is unique to part of the business.

Step 4: Confirm any hypotheses that you have

By this stage, you should have uncovered one or more causes of the profitability issue outlined in the case study.

For example, you may have come to know that the average revenue per sale has dropped and variable costs have increased, confirm the same with the interviewer.

Test these with the interviewer and make sure you’ve identified the main hypotheses. If you’ve missed something, the interviewer will usually steer you in the right direction.

Step 5: Summarize your understanding of the problem and recommendations

After you’ve narrowed down your hypotheses, it’s time to think about solutions.

Ask the interviewer whether you can take 1-2 minutes to synthesize your findings and formulate recommendations (they will always give you this time).

First, focus on identifying the underlying issues with the biggest influence on profitability and prioritize those. You want to show that you can identify the “absolutely important” from the “merely interesting”.

Now think of potential solutions to those problems that you have identified. But don’t just think of generic solutions, you should think from the point-of-view of your specific company and include industry context.

For instance, if your client is an aviation company, include some industry-specific detail in your summary (maybe airline regulations, aviation fuel prices, etc.).

Tips for acing a profitability case interview question

There are a few things that can do to ensure you answer the case interview question well:

- Learn how to identify profitability questions: Candidates often overlook the fact that profitability questions aren’t always obvious. Practice identifying which case studies are profitability questions to ensure that you’re applying the correct framework.

- Master the math: Profitability questions are all about breaking down using mathematics, so ensure that you’re confident in breaking down the question using the profitability equation.

- Don’t be afraid to ask questions: Case interview questions are designed to be complex and ambiguous. Always ask the interviewer if you need more information or want to clarify your understanding.

- Prioritize the biggest drivers: Most case studies will have multiple issues — but not all issues will be important. Show that you have practical business sense and prioritize the most important problems over the others.

Example profitability case interview questions

Example 1: Global retailer

Your client is a US-based fortune 500 company. It is one of the retail chains in the world. It was profitable and growing through the 1990’s. In 1999, it’s revenues were $14.1 billion. Since then revenues have been declining and the net income has been inconsistent. Help advise the company on how to improve profits.

Example 2: Chemical manufacturer

A major chemical manufacturer produces a chemical product used to preserve foods in containers. Despite an increase in market share, the manufacturer has experienced a decline in profits. The CEO of the company is worried about this trend and hires you to investigate.

Example 3: Cable TV company

A cable TV company from Canada, World View, had recently entered the US market in the northeast to expand its market share. World View saw this move as an opportunity to capture a large part of the US market (4MM consumers) in a market with very little competition.

However, in the last couple of years, much to the surprise of management, World View has been unable to make a profit. You have been hired to figure out why and advise them on their next move.

Example 4: Auto service chain

A major auto service chain, Wheeler Dealer, has enjoyed healthy returns on its 30-store operation for the past 10 years.

However, management feels that the chain needs to expand, as the current geographical areas in which they are based have become saturated.

For the past couple of years, they have aggressively pursued a growth strategy, opening an additional 15 stores. However, it seems that this approach has had negative returns. For the first time in over a decade, the chain’s profits dropped into the negative zone. You were hired to figure out why.

Example 5: Travel agency

A travel agency makes a 10% commission on all of its travel bookings. Their current profit before taxes is $1MM, while the industry average ranges from $2MM to $3.5MM. Why are they making less than the industry average?

Example 6: Hospital

Our client is a 350-bed hospital in a mid-size city. The organization has historically exhibited strong financial performance, and had a 1-3% operating gain each year for the last five years.

However, they are projecting a $12 million operating loss this year, and expect this situation to worsen in the future. As a result, the CFO believes that they will be out of cash within five years.

They have asked us to identify the source of this sudden downturn, and to come up with alternatives to restore them to a break-even position. They are one of the largest employers in the market, and will not consider layoffs as a possible solution.

Example 7: Fast food chain

Six months out of HBS, a frustrated classmate calls you to complain that the fast food burger joint that he bought has been steadily losing money for the last 3 months. He wants to know what you think he should do about it. Where do you start?